Soft tissue shockwave therapy (STS) coverage varies among insurance policies, often categorized under physical therapy or alternative medicine. Patients should check in-network provider status, pre-auth requirements, and referral rules from primary care physicians to ensure optimal STS coverage. Verify specific plan inclusion, associated costs, and pre-authorization needs before scheduling sessions for pain relief and muscle recovery.

Discover if insurance covers your path to pain relief with soft tissue shockwave therapy. This innovative treatment has gained popularity for its ability to heal muscle, tendon, and ligament injuries. However, understanding coverage can be complex. We’ll guide you through navigating insurance policies, exploring reimbursement options, and considering essential factors. Learn how to access this effective therapy and start your journey towards reduced pain and improved mobility today.

- Understanding Soft Tissue Shockwave Therapy Coverage

- Navigating Insurance Policies for These Sessions

- Exploring Reimbursement Options and Considerations

Understanding Soft Tissue Shockwave Therapy Coverage

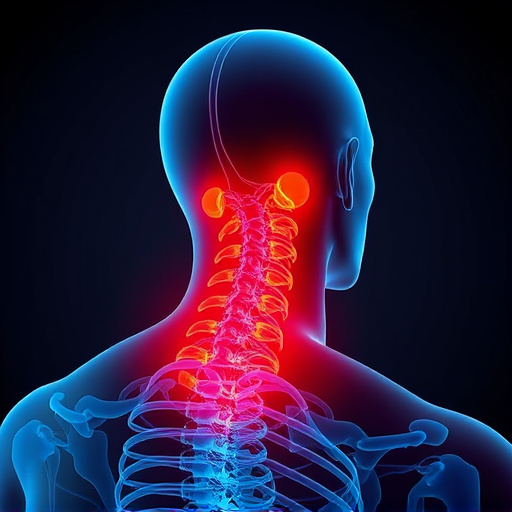

Soft Tissue Shockwave Therapy (STS) is a non-invasive procedure gaining popularity for various treatments, including headache relief and neck pain treatment. When considering coverage, it’s essential to understand that insurance policies can vary significantly. STS sessions are typically categorized under physical therapy or alternative medicine, which means their reimbursement policies may differ from traditional medical procedures.

Many insurance providers offer partial or full coverage for STS as part of a functional rehabilitation plan. This is especially true for policies focusing on preventive care and wellness. However, policyholders should review their specific plans to confirm in-network provider status and understand the scope of coverage. Some plans might require pre-authorization for STS treatments, while others may not cover it at all without a referral from a primary care physician.

Navigating Insurance Policies for These Sessions

Navigating Insurance Policies for Soft Tissue Shockwave Therapy Sessions

When considering soft tissue shockwave therapy sessions, understanding your insurance coverage is crucial. Many traditional insurance plans may not explicitly list this emerging treatment method in their benefits, so it’s essential to scrutinize your policy details. While some policies might cover certain aspects of post-injury care and spinal adjustment techniques that can be related to the procedure, direct reimbursement for the therapy itself may vary significantly.

It’s worth noting that many providers are increasingly incorporating these sessions into their practices, recognizing the potential for neck pain relief. As such, some insurance companies are updating their policies to reflect this trend. However, patients should always verify with both their insurer and healthcare provider before scheduling treatments to avoid unexpected out-of-pocket expenses.

Exploring Reimbursement Options and Considerations

When considering soft tissue shockwave therapy sessions, exploring reimbursement options is a critical step. This non-invasive treatment has gained popularity for its effectiveness in muscle recovery and alleviating pain associated with various conditions, often sought after as an alternative to surgical intervention or stronger pharmaceuticals. Insurance coverage for such therapeutic sessions can vary widely depending on the provider and your specific plan.

Many health insurance plans do offer reimbursement for certain types of chiropractic care, including soft tissue shockwave therapy, when recommended by a qualified healthcare professional. However, it’s essential to verify if your particular plan includes this treatment and understand the associated costs. Some insurers might require pre-authorization or have specific criteria for coverage, such as diagnosing a specific condition or exhausting other treatment options first. Therapeutic exercises and muscle recovery techniques, often incorporated into these sessions, may also be covered under certain circumstances, further enhancing potential savings.

Soft tissue shockwave therapy (STSWT) coverage varies among insurance providers, so understanding your policy is essential before embarking on treatment. Navigating insurance policies for STSWT sessions involves meticulous exploration of terms and conditions. By exploring reimbursement options and considerations, patients can ensure they receive the necessary care while managing financial obligations effectively. Remember that staying informed about these details is crucial to a successful and affordable experience with STSWT.